Looking for the best car insurance on Reddit? We compiled a list of the most popular and reliable providers. Use this information to compare rates and policies and find the right coverage for you.

When you are looking for the best car insurance rates, comparing rates is the best way to get the cheapest car insurance. There are a variety of different companies that offer car insurance, so it can be difficult to compare rates and find the best deal. However, free quotes from several different companies can help you decide which policy is right for you.

Keep in mind that not all companies offer free quotes. Some may require you to sign up for a service or pay a fee before providing quotes. It’s important to do your research and find a company that offers free quotes without requiring additional commitments.

Another way to save on car insurance is to shop around online. Many insurers offer online discounts and special offers, so it’s worth checking out their websites before shopping in person. Most major insurers have websites that are easy to use and navigate.

Who has the best car insurance?

The debate over who has the best car insurance is an eternal one. Some people swear by GEICO, while others swear by State Farm. But which company is the best? We took a look at the facts to find out.

First, it’s important to look at what factors are most important to you when it comes to car insurance. Are you worried about damage to your vehicle in any event? Or do you focus more on comprehensive coverage, which includes things like property damage and theft?

Next, consider your driving history. Are you a safe driver who takes care of your car? Or are you more of a risk taker who has had some accidents in the past? Finally, think about how much money you want to spend each year on car insurance.

State Minimum Insurance is Almost Never Enough:

State minimum liability insurance is tempting because it’s cheap. But most people don’t know that state minimum liability coverage leaves you exposed.

A car accident can leave you with a huge bill, and state minimum liability insurance only covers $50,000 in damages. That means if you’re hit by someone driving without proper insurance, you could be left with a bill in the thousands of dollars.

To protect yourself, always make sure to have enough insurance to cover your entire car and any passengers. And be sure to check your policy limits regularly to make sure they’re still adequate.

While the maximum amounts vary by state, $100,000 for bodily injury and $50,000 for property damage are usually good guidelines to follow.

Personal injury protection (PIP) is a type of car insurance that provides benefits if you are injured in an accident. In some states, PIP is mandatory even if you have personal insurance that covers medical expenses. This is known as “tort reform.” Tort reform is a policy change that limits the amount of money people can sue for damages. It’s designed to make lawsuits less expensive and discourage people from taking legal action unnecessarily.

Some states require you to have PIP even if you’re not at fault in an accident. This is called “no-fault” or “all-risk” coverage. No-fault states think that everyone should be able to get insurance, no matter what their driving record may be. All-risk coverage means that your insurer will pay for your medical bills regardless of who’s responsible for the accident.

Compare Car Insurance Quotes Instantly:

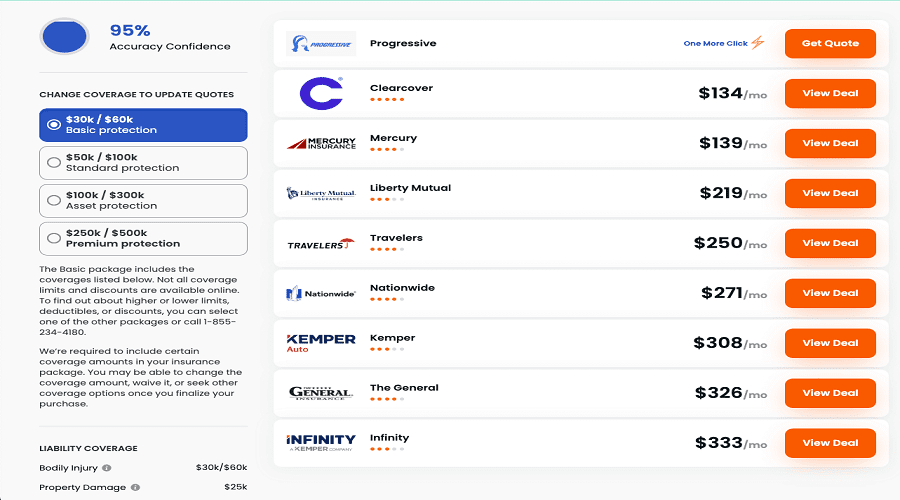

Comparison shopping for car insurance is an essential part of smart living. By comparing rates from multiple insurers, you can find the best policy for your needs at a price you’re comfortable with.

Using an online tool like Insure.com makes the process quick and easy. Simply enter your zip code and the type of vehicle you drive, and our site will generate a list of quotes from the top-rated insurers in your area. You can compare rates side by side or filter by features such as deductibles, coverages, and discounts.

Once you’ve chosen a policy, make sure to read the fine print carefully to understand each company’s coverage policies and exclusions. As with any financial decision, it’s important to get independent verification that the rate quoted is actually affordable before signing on the dotted line.

Make Your Deductible Reasonable

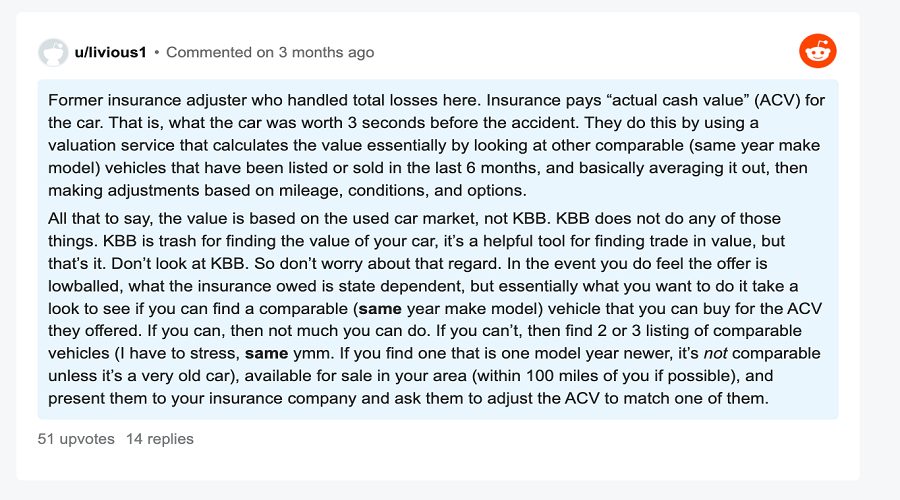

Reddit is a great place to look into the viewpoints of people from the insurance industry. The user highlighted the wisdom in realizing that if you can’t afford your deductible, you won’t be able to respond to the insurance process quickly and have your damaged vehicle fixed. You will receive the full value of your car irrespective of whether or not you have to spend the deductible. For that reason, don’t be inhibited from making a late payment.

When you’re purchasing automobile insurance, don’t forget to work with your insurance agent to find out what deductibles are accessible. Coming up with a higher deductible will decrease your premium costs, but it may not make the cost worthwhile enough to allow you to afford it, even if you usually are in a position to afford it with ease.

How Much Car Insurance Do I Need Reddit?

Sometimes it functions as a struggle to make a choice between a future risk, you aren’t psychic (I suspect). We do not know what will happen in the future. Will you incur an accidental injury? Perhaps. Maybe not. Having a great deal of insurance coverage may be a great thing you did or a total waste of cash. No one can say for sure. ZBTHorton, Redditor, offers a simple question about Reddit.

One simple method to consolidate your thinking about the choice to purchase liability-only or full insurance is to ask if you can undertake your auto replacement without insurance and rely on your own mind if necessary.

One method to consolidate your thinking regarding the choice to purchase liability insurance only or full insurance for yourself is to ask Can You Use Your Own Consideration in the event of injury or vehicle replacement if insurance is not possible?

We asked Reddit Car Insurance Sub: Is Full Coverage Worth It?

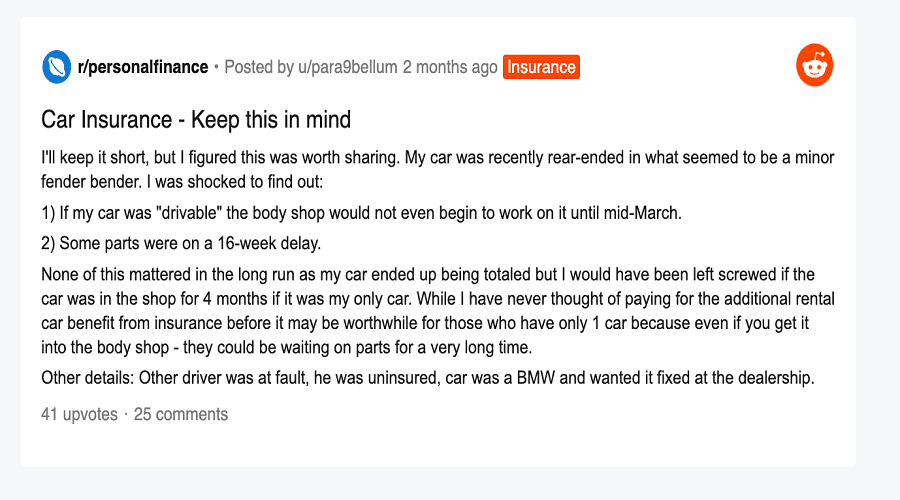

Comprehensive and liability, as well as collision, comprise the comprehensive and collision policy package. When is it advisable and carried? On Reddit, many different people say they always carry a comprehensive and collision policy and are scared they may not. For some, it’s better to carry the policy and not be too confident, while for others it’s better to be on the safe side and pay for a comprehensive and collision policy.

You may not have ever thought about accidents in St. Louis, even while it’s still parked. It will be very hard to make an alternate arrangement for an occasion you’re not even acquainted with, so having full coverage insurance will allow you to feel more secure. Some individuals would rather be secure than worry a bit about costs and insurance.

What Do I Do If I Just Need Short-Term Car Insurance?

It’s easy to concentrate on temporary car insurance quotes when purchasing only for a short time. When you purchase short-term, most insurance companies only sell six-month or one-year policies.

Since your insurance company typically gives month-to-month options for vehicle insurance, they probably aren’t focused on claims handling or customer relations. On Reddit, Reddit user xpen25x had a great suggestion for car insurance.

When issuing short-term car insurance policies, The General is best known for making certain that difficult or extreme cases are handled, especially those involving short-term car insurance policies. Make sure that you read your policy in full before making payments, as there may be clauses you are unaware of. They also point toward going to a broker and discussing your requirements. This may be an extremely easy way to locate what you need since the broker will do every one of the digging and research for you. If coverage from hard-to-insure firms just isn’t adequate, Zab11 had some beneficial words to follow.

What About Gap Insurance?

If you want to acquire car financing, full coverage will normally be provided, but you might also be offered gap insurance. This protects you in the event of an accident that causes you to exceed your financial plan, and the actual cash value of your insurer is less than what you owe on your loan.

Gap insurance means that, even if the vehicle is unattainable to drive on account of repairs, you aren’t liable for the balance of the loan on the vehicle. Your dealer may offer this, but koifishyfishy suggests that the dealer may not be the best option for this.

In Closing

In conclusion, we recommend the best car insurance on Reddit to anyone looking for a comprehensive and affordable coverage option. Whether you’re a new driver or have been driving for years, these companies can provide you with the coverage you need to keep yourself and your family safe on the road. So if you’re looking for some great car insurance deals, be sure to check out the best Reddit car insurance companies!